European Toy Market: Trends, Insights, and Forecast

Since 2020, it’s impossible to talk about the best toy industry trends in Europe without correlating the fact of how the coronavirus has changed our routine and our daily needs and desires for products and services. While some sectors suffered from the effects of the pandemic, others saw a rise in sales – some toys & games industries included.

If you are interested in the European toy market, this blog will provide insight and forecast into the 5 most important toy industry trends in Europe for 2022.

Effects of Covid-19 on Toy Industry Sales

In the EU economy, many important sectors are declining with the impact of the pandemic. Referring to the 2021 study by the ITRE committee – European Parliament, the sectors that are suffering most in the short term are Automotive, Textile, and Industrial. Markets that need human contact and interaction to survive will likely suffer a long-term hit, such as Culture & Entertainment, Creative, Aviation & Aerospace.

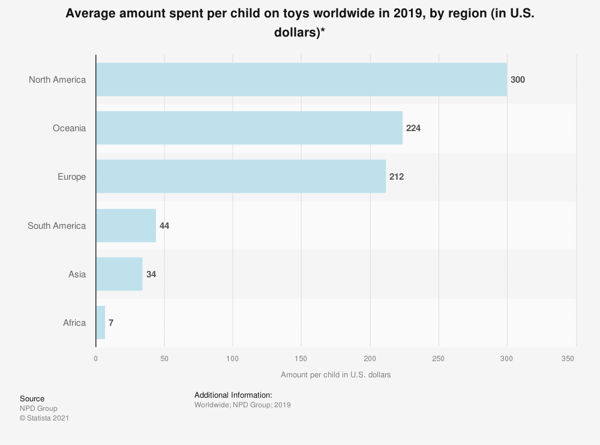

Yet, other markets experience a profitable moment in sales and exports. The European toy market size comes in third in sales, behind North America and Asia. Even though it’s represented by 99% of medium-sized companies.

The graphic below demonstrates that in 2019, the annual amount spent on toys per child in the EU was estimated to be $212. The total EU toy market size was estimated to be $24.6 billion. From 2022 to 2025, this value is expected to have a compound annual growth of 15.59%, projecting a volume of $96,537M by 2025.

Toy Trend No. 1 – Toys to Learn & Stimulate the Senses

Since the rise of Covid-19 in 2020, one aspect that is influencing European toy industry sales is the demand for toys that emphasize interdisciplinary learning. This is also known by the term STEAM Toys (Science, Technology, Engineering, Arts, and Math). Parents are seeing more value in toys that not only offer fun but also teach and reinforce STEAM skills in their children.

Another addition is sensorial components in toys that offer a mix of sensations to children in order to develop their hearing, vision, touch, smell, and taste. These multisensory toys, such as slimes and putties, offer a release for stress and anxiety during crises and schools lockdown. These toys are also known as fidget toys or SEL (Social-Emotional Learning), and they are among the most popular European toys at the moment.

Toy Trend No. 2 – Sustainable Toys

Sustainability is much more than a hyped toy industry trend. It’s becoming a way of life for many consumers. The importance of buying greener, healthier, more ethical products has accelerated its infiltration and reflects the habit of buying toys in recent years.

According to the Kids & Family Industry Report 2021, 69% of toy companies believe they can make a difference in the sustainability industry. The principal brands developing environmental strategies worldwide are LEGO, Hasbro, Mattel, MGA, Playmobil, and Clementoni. They understand that a clear environmental strategy can give them a competitive advantage while remaining relevant.

It's already possible to identify four product categories relevant to this toy trend, based on the European toy fair trades in Europe, such as Spielwarenmesse International Toy Fair.

- Made by Nature: Cork, bamboo, and similar materials

- Recycle & Create: Toys made from recycled materials

- Inspired by Nature: Bio-plastic or other bio-based composition

- Discover Sustainability: Toys that can display and educate children about

environmental topics

Toy Trend No. 3 – E-commerce x Brick & Mortar Retailers

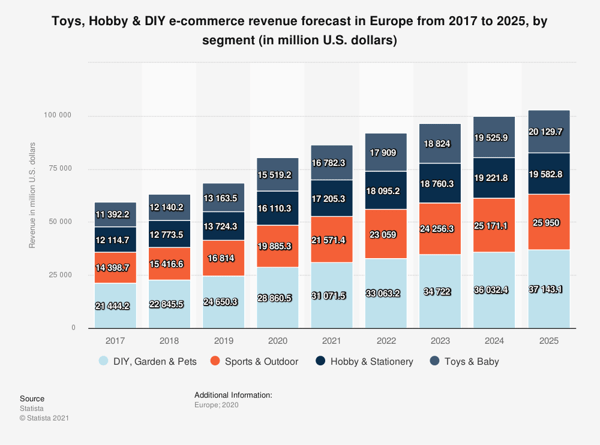

According to the European Toy Industries Association, online sales are increasing, pointing at another toy trend – over 1 in every 4 toys in Europe is sold online. In the EU, 5,600 toy companies are SMEs, and most have less than 10 staff members. With one lockdown after another, it’s difficult to maintain many physical retail points. New strategies are needed to keep selling, reflected in an increased number of sales via e-commerce.

Consumer behavior also adapts to this new reality and strongly influences European toy distributors, logistics, and production volumes. Physical outlets will gradually be a showcase to display what is sold online. A good example from the Netherlands is Coolblue. They focus their marketing efforts to promote and sell from their online platform. The physical stores are low in stock and offer a trial experience, consultancy, and a pickup spot for your online purchase. The brick & mortar retailer became a sales effort support for the customer to finalize their purchase online.

More toy manufacturers are investing in e-commerce to be able to sell directly to the end consumer since it’s difficult to predict the closing and opening of stores due to the lockdowns.

Learn how our expertise in the E-commerce market in Europe can help you out.

Toy Trend No. 4 – Home Entertainment & Videogames

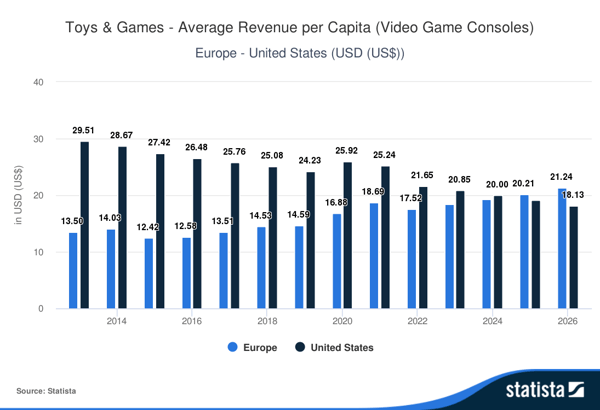

Over the last 3 years, the European toy market size in the sub-category of game consoles has been getting closer to the revenue in the United States, which is considered one of the biggest markets in the world. It's estimated that this year, the US will obtain a revenue of $21.65 per capita. European countries tend to achieve a revenue of $17.52. Toy industries analysis 2022 shows that European revenue is expected to surpass the United States by 2025.

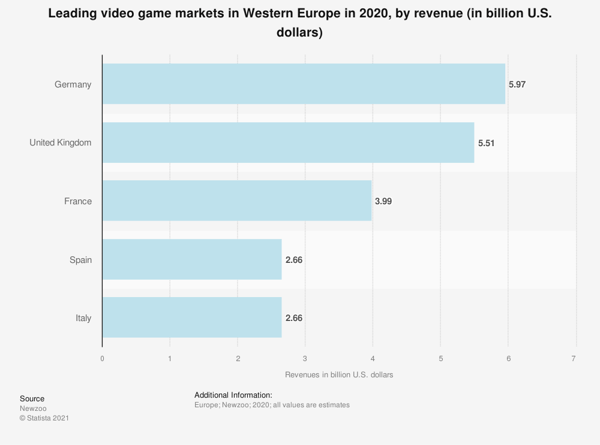

Inside the EU, Germany is the #1 country to achieve the most revenue, reaching $5.97 billion. The UK follows closely with $5.51 billion. Other interesting markets for North American manufacturers in the video game industry are France, Spain, and Italy.

Toy Trend No. 5 – Safety Regulations for Baby & Small Children’s Products

The last of the most important toy industry trends is one for the young ones. In Europe, there has been a lot of attention to the safety of toys and other products for babies and small children. Europe’s revenue is ahead of the US ($9,752M vs. $7,333M), which presents interesting opportunities for manufacturers and brands who are looking to expand their business.

In December 2021, a committee of the European Parliament voted on a report about the safety of children’s toys. This document is a proposal to strengthen the safety and reduce health risks from toys sold in Europe. All European toy retailers will have to comply with these regulations. In January 2022, the committee will vote to approve these changes:

- Stricter testing of imported toys for safety and analysis of how sustainable

they are; - Verifying manufacturers’ documentation with the goal of withdrawing unsafe

toys and acting against those responsible for placing them on the market; - Online marketplaces should ensure that products sold on their platforms

conform to EU safety requirements; - Stricter requirements for chemical substances in toys for children under 36

months of age and toys that are intended to be placed in the mouth; - Banning more products containing hazardous substances:

– Bisphenol A (BPA) – used as a coating for baby bottles, can interfere with

brain development.

– Phthalates – used to soften plastics, e.g. in swimming pools.

– Nonylphenol ethoxylates (NFE) – are used for the production and cleaning

of textiles.

– Harmful preservatives – used in baby wipes, can cause eczema or disrupt

hormones.

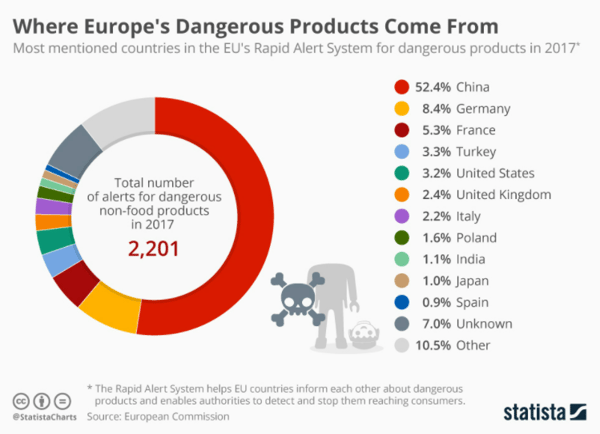

The new regulations could sound like a challenge for manufacturers hoping to enter the European market. It’s important to take into consideration that North America is much further ahead in creating safe products than some other supplier markets, like China.

Helping NA Toy Manufacturers Enter the EU Market Since 1996

Keeping in mind what the important toy industry trends for Europe are, there are many interesting opportunities for toy manufacturers and brand owners from the USA or Canada to expand into the European toy market. There is a sweet spot for products that are compliant with safety regulations, sustainably sourced and produced, stimulate learning, and can be bought online.

How many boxes does your product tick? Let us know, and we will be glad to assist you further with getting your boots on the ground in Europe.

Bonus read: Expand business into Europe with EuroDev Sales Outsourcing services

Category

Related articles

-

People Analytics: Transforming HR for European Expansion

17 September 2024Discover how people analytics can transform HR management, aiding companies in navigating the...

Read more -

Navigating Retail Recruitment and Employment in Europe's Top Markets.

30 August 2024Explore retail recruitment and employment, labor insights, and strategic hiring approaches in...

Read more -

Leveraging the European Hospitality Industry for Retail Success

24 May 2024Leverage the European hospitality industry to drive retail success by accessing a global customer...

Read more