Architectural Services Market in Europe: Reduce Risk and Expand

Factors such as timing, scale relative to the competition, and the ability to leverage complementary assets are the keys to successful entry into the European architectural market. And, while it does seem demanding, entering a new market such as Europe can be an excellent opportunity for a company's annual ROI, new interesting projects, and challenges that expand your knowledge base. While the costs of miscalculation can be extensive, how can you reduce your risk?

When expanding to a new market, one of the first steps to take is market research. Learn more about the architectural market in Europe and the risks you want to avoid when looking for projects.

Understanding the European Architectural Landscape

In the European market, not all architects are primarily concerned with building design. The proportions involved in that type of work differ by country and are particularly low in Italy (only 41%), where the situation is defined by the moderate construction market. For comparison, the UK has a significantly larger construction market but a lower number of registered architectural offices.

Planning defines only a very small proportion of architectural work (less than 3%) and has been declining in Europe since 2008. Besides differences in the number of architects, we see further persistent differences concerning gender, the sizes of practices, and the types of work undertaken by architects.

Architects in local markets

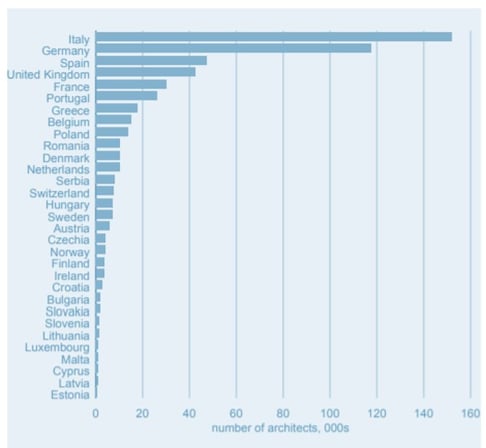

There are an estimated 559,070 architects, a total of 111,187 registered architectural practices in the EU. Italy has the largest number of architects, with 152,000 architects. Germany has the second highest number, which accounts for 118,000 architects. The other countries with the highest numbers of architects are Spain (48,000), the United Kingdom (43,000), and France (30,000). Between them, these five countries are home to 70% of Europe’s architects.

Despite the efforts toward European harmonization and European transnational planning projects (e.g. Interreg), national differences continue to play an important role in planning systems and cultures.

European Architectural Market Opportunities and Size

The total value of the architectural market in 2020 for Europe is estimated to be €17 billion. This figure relates to the total value of the revenue generated by the profession. The largest architectural markets are in Germany, the United Kingdom, Italy, and France. They account for two-thirds of the market in Europe overall.

The European Commission states that the average enterprise in the European architectural sector has fewer employees than the average enterprise across all economic sectors. In almost all Member States, the average enterprise would have two or three times more employees than the average architectural office.

Market segmentation

Based on a European architect survey and statistics, private housing remains the most important sector for architects, generating 54% of average practice turnover. The remaining 46% of average practice revenue was split between commercial and public sectors. Neither sector accounts for more than 10 percent of practice revenue.

Generally, in Europe, the office sector represents 9% of average practice revenue, and other private – including mixed projects – accounts for another 6%. Education accounts for 7% of average practice turnover.

Office work accounts for a higher proportion of practice revenue in countries including Finland, Norway, and Slovenia. A larger proportion of practice turnover comes from retail in Spain.

Overcoming Regulatory Challenges and Competition

For the last twenty years, the main challenge for the architectural profession in Europe has arisen from EU harmonization, involving both deregulation and re-regulation at all political levels (cf. Le Bianic, Svensson 2010). For the architectural profession, the consequences are mixed since European harmonization means recognition of architecture as a profession but also rigorous deregulation.

Looking at architectural services, the majority of consumers (and corporate clients) in some Member States prefer individual projects and local consulting. Such consumer demands may be best served by small, local architectural offices. In the case of larger intercity solutions, the size advantages of a large company with more employees would be more beneficial.

Without systematic restrictions on entering the market, there are no arguments against firm structures other than the European (almost standard) small companies entering the market, even if this means consumers pay higher prices for more individualized solutions.

More information

Interested to learn more about your company's potential to expand into the architectural European market?

Discover how our Sales Outsourcing solutions can meet your specific needs. Feel free to schedule a meeting with us, we will be more than happy to guide you through your European expansion.

Sources: Architecture Quote, Bloomberg, European Commission

Category

Related articles

-

Europe's Water Treatment: Challenges and Opportunities

25 March 2025North American companies explore opportunities in Europe's evolving water treatment and wastewater...

Read more -

The Rise of Electric Vehicles in Europe

10 March 2025As we move into 2025, electric vehicles (EVs) are no longer a niche market but a mainstream choice...

Read more -

Pivotal Moment for North American Offshore Technology Companies

23 December 2024As the global demand for renewable energy and efficient maritime operations continues to rise,...

Read more