Beyond the Blast: Europe’s Furnace Transition

The past few years have presented significant challenges to Europe’s steel industry. Once the backbone of its major economies, these institutions are now facing unprecedented challenges. Economic, regulatory, and environmental pressures have in recent years all aligned to put it under extreme duress. In the face of a potential period of sustained decline, there is an urgent need for innovative solutions. One focus point of this transition is the blast furnace, one of the main components of steel production. This article will explain why the blast furnace is now subject to a makeover, and what this transformation will look like.

What is the current state of the European steel industry?

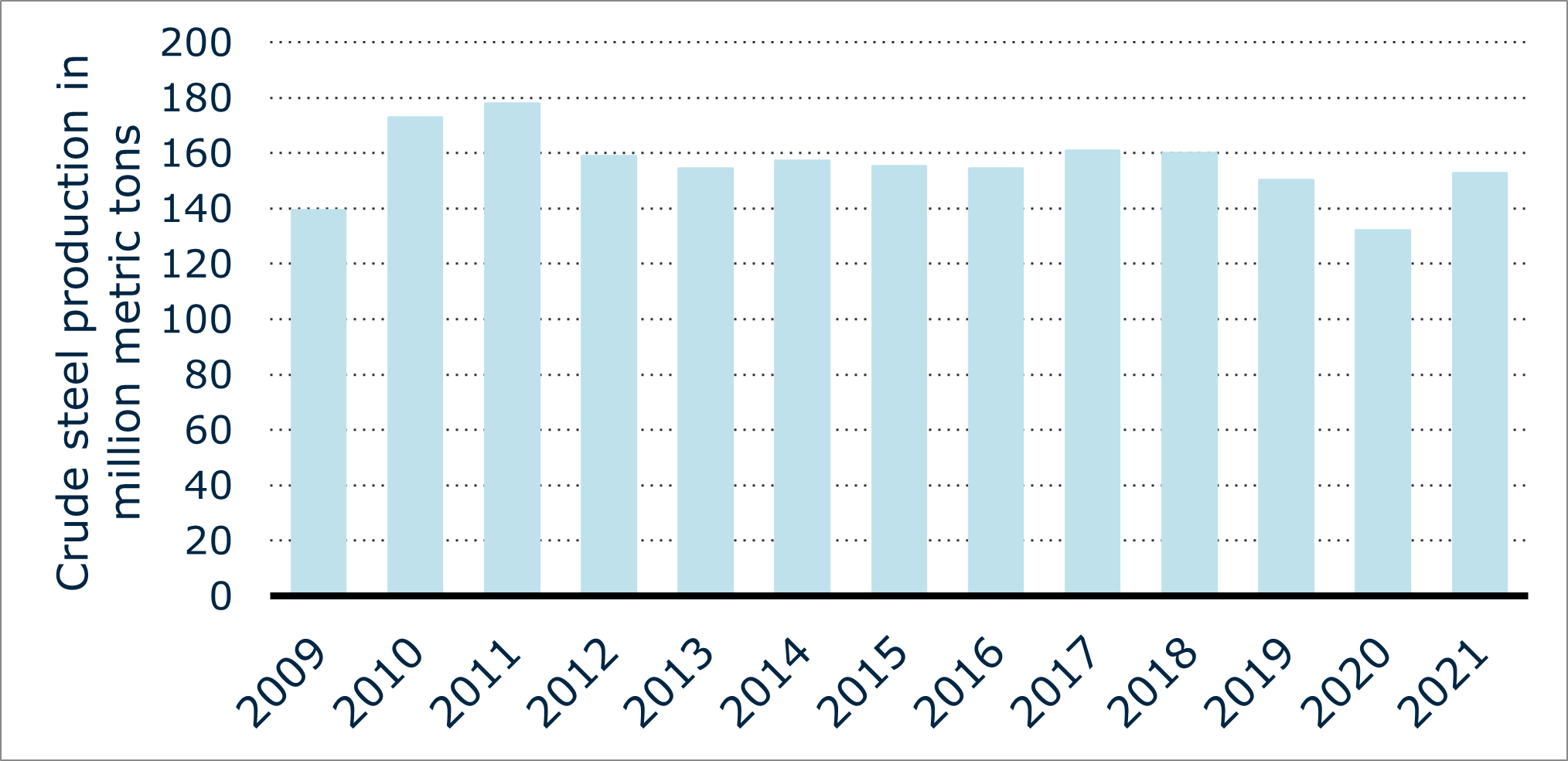

As previously stated, the industry finds itself in a troubling position and faces a need to change itself. Despite a brief surge in demand for steel and iron during the COVID-19 pandemic, the apparent demand (steel output plus net export) for steel in the EU had overall been in a period of sustained decline for the past five years. As such, the production of crude steel has also been gradually diminishing in numbers, as seen in the diagram below. The reasons for this are multi-varied.

Annual production of crude steel in the European Union (EU-27) 2009-21

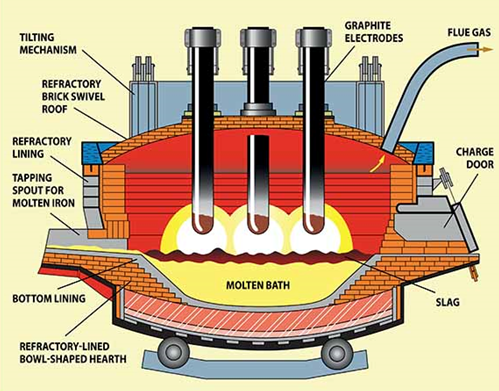

One main reason is environmental concerns, with steel products responsible for almost 11% of all CO2 emissions. From that, almost 4% comes from blast furnaces alone. The process relies heavily on coal: as a source of heat and as part of the chemical process. Thus, the industry is also facing regulatory pressure from the EU to reduce its emissions.

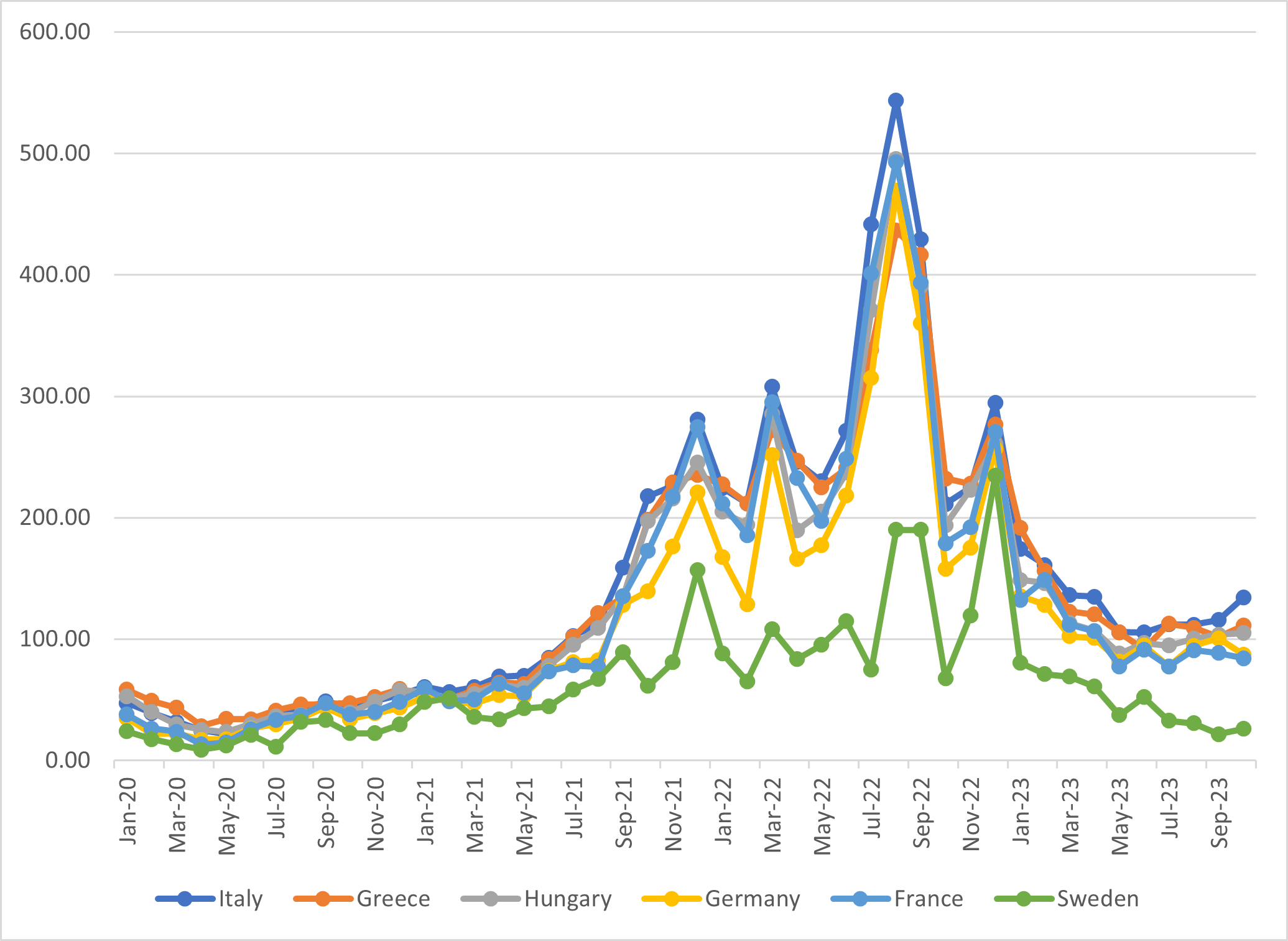

Another problem is that they are energy-intensive and thus costly. Energy constitutes a significant portion of the cost of steel production - 20 to 40% - with the blast furnace being the largest consumer of this. As a result of the Russo-Ukrainian war, energy prices have soared in most of Europe. Although they have come down again, in select countries they remain above their pre-pandemic prices.

Average monthly electricity wholesale prices in selected EU countries

These factors have contributed to many steel companies leaving their blast furnaces idle or shutting them off completely. For example, despite recently acquiring a steel mill in Hungary in mid-2023, the British firm Liberty Steel is now decommissioning the sole blast furnace at that facility. In these troubling times, there is a silver lining for the industry. Alternatives to the conventional process are being developed, with some already being implemented.

What are the alternatives, and how are they put in place?

One decarbonization method that is already in use across several mills is the Electric Arc Furnace (EAF). It replaces coke with electricity as the main source of energy, and instead of raw iron ore, it uses obsolete scrap metals as the main source of material. It is smaller in size, less costly, and more efficient. Importantly, CO2 emissions are significantly lower compared to the conventional method, with one estimate putting it at 85% lower. However, the metal produced is of a lower quality and quantity compared to the conventional method. In addition, the continued usage of electricity does not resolve the current issue of high energy prices. Thus, instead of directly replacing traditional blast furnaces it is often utilized alongside it.

Another method, that has been around for nearly 60 years, involves replacing iron ores with other materials. The two most popular are Direct-reduced Iron (DIR) and Hot-briquetted Iron (HBI). As these are high-metalized versions of Iron, they reduce the consumption of polluting reducing agents (i.e. coke). Therefore, despite being more costly than raw iron ores, their application reduces the overall CO2 emissions of blast furnaces.

Another decarbonization solution currently still in trial mode is Hydrogen Injection. In this method, hydrogen is used to replace coke as a reducing agent. Instead of producing CO2 as a by-product, H2O is created. In addition, the new hydrogen process requires lower temperatures compared to the conventional one, allowing for the usage of EAFs. Several major players, such as ThyssenKrupp and Tata Steel, have begun trialing hydrogen injections at their facilities.

What are the implications of this transition?

Ultimately, to achieve carbon neutrality all three method types must be utilized. For example, using a combination of all three processes the Swedish firm SSAB expects to start offering fossil-free steel to the market by 2026. However, the level of investment required for this transition is hefty. Even with government assistance, not all steel companies are guaranteed to survive. Several are already standing on their last legs.

Given this, European steel manufacturers may be forced to pass on the investment costs to their customers, resulting in higher prices. Also, an international scramble for scrap metal, a vital component of the EAF method, could further drive up prices. Lastly, there are still open questions concerning the quality of the steel produced using green methods.

This transition presents threats and opportunities for various actors. For Europe’s manufacturing, industry these developments are a clear threat to their costs and product quality, possibly forcing them to start looking for steel and iron products outside the continent. This could therefore represent a temporary opportunity for steel manufacturers outside of Europe. This shift also opened a market in Europe for technologies and materials needed to produce ‘green’ steel. Lastly, as Europe now becomes a testing ground for this transformation, it can prove to be a useful learning opportunity for those outside it.

Ready to expand into Europe?

Learn more.

Category

Related articles

-

Europe's Water Treatment: Challenges and Opportunities

25 March 2025North American companies explore opportunities in Europe's evolving water treatment and wastewater...

Read more -

The Rise of Electric Vehicles in Europe

10 March 2025As we move into 2025, electric vehicles (EVs) are no longer a niche market but a mainstream choice...

Read more -

Pivotal Moment for North American Offshore Technology Companies

23 December 2024As the global demand for renewable energy and efficient maritime operations continues to rise,...

Read more