Mileage Reimbursement in Europe 2022

The reimbursement of travel expenses is aimed to cover employees' commute costs to reach their place of employment. As every country in Europe covers these costs at different rates, and it is the responsibility of the employer to cover these expenses, we have gathered all the latest information. Here is the 2022 mileage reimbursement update for Europe.

-1.png?width=644&name=mileage-reimbur_48355894%20(1)-1.png)

Mileage Reimbursement in Austria

The Austrian rate for mileage reimbursement is € 0.42 per km for a car. The official mileage allowance can be recognized for a maximum of 30,000 kilometers per calendar year.

Mileage Reimbursement in Belgium

The Belgian rate for an employee is €0.3707 per driven kilometer. The mileage allowance is neither subject to social security contributions nor to payroll tax. The employee is due to pay social security contributions on this amount. An additional condition is that the number of kilometers per year should not be abnormally high (max. 24.000 kilometers per year). If the number of kilometers is higher, proof must be provided.

Mileage Reimbursement in Croatia

The tax-free reimbursement in Croatia is 2 Croatian Kuna per kilometer. This is equivalent to €0.27.

Mileage Reimbursement in the Checz Republic

The basic rate for 1 km compensation for the motor vehicles is CZK 4.70 or €0.19.

Mileage Reimbursement in Finland

The tax-exempt kilometer allowance by private car is €0.46 per km.

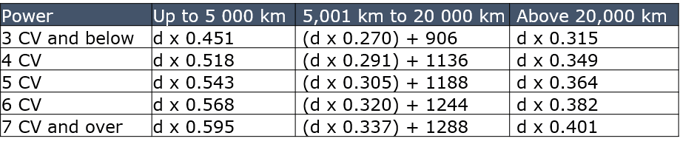

Mileage Reimbursement in France

The French system is a bit more complex and the reimbursement rate is depending on the type of car and the total amount of driven kilometers:

Mileage Reimbursement in Germany

A German employer is allowed to reimburse €0.30 per kilometer tax-free for a car. Please note that this is only allowed when confirmed by a particular listing reflecting the date/reason/driven distance and trip route with a private car. For an amount above 20 km the reimbursement rate increases to €0.35.

Mileage Reimbursement in Hungary

A flat rate of HUF 9 (€0.023) per km and petrol usage reimbursement (upon a receipt).

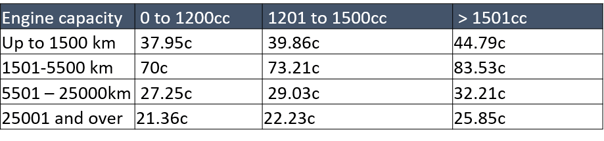

Mileage Reimbursement in Ireland

The Irish system is also using a system where the reimbursement is depending on the type of car and the kilometers per year:

Mileage Reimbursement in Italy

Italy has many different legal mileage reimbursement rates, depending on the engine category, the car manufacturer, type of fuel, and engine capacity. If you would like to learn about specific mileage reimbursement rates in Italy, we would be more than happy to assist, so don't hesitate to contact us.

Mileage Reimbursement in the Netherlands

An allowance of €0.19 or less per kilometer is free of tax and social security contributions. If an allowance exceeds €0.19 per kilometer, the Dutch tax authorities will regard the excess as (taxable) wages.

Mileage Reimbursement in the United Kingdom

In the UK, mileage reimbursement is considered a benefit for employees, so employers are not obligated to pay. However, many choose to reimburse their employees for business mileage, because anything paid under or at the same level of the approved mileage is not reported to the authority. The mileage reimbursement per kilometer for a car in the UK is 45 pence for the first 10.000 miles and above 25 pence.

Mileage Reimbursement in Poland

In Poland, the mileage reimbursement depends on the car cc. A car below 900 cm3 is 0.5214 Polish Zloty (€0.11) per km and a car above 900 cm3 is 0.8358 Polish Zloty (€0.18).

Mileage Reimbursement in Portugal

A Portuguese employer can reimburse up to €0.36 per km.

Mileage Reimbursement in Spain

The tax-free rate is €0.19 per kilometer, and everything on top is taxable.

Mileage Reimbursement in Slovakia

The amount of the basic compensation for using the road motor vehicles for business trips is €0.193 per km

Mileage Reimbursement in Slovenia

Refund of costs raised based on actual costs or €0.37 per kilometer for the use of their personal car for business purposes. The employee has to ask permission upfront for his expenses and has written proof of approval from the employer.

Mileage Reimbursement in Sweden

SEK 18.50 per 10 km for your own car. This is equal to €1.76 per 10 km.

Mileage Reimbursement in Switzerland

CHF 0.70 (€0.67) per km with a total mileage of up to 10.000 km per year. If the total mileage is over 10.000 km per year, the mileage reimbursement is CHF 0.60 (€0.58) per km.

For more information about the mileage reimbursement, don't hesitate to reach out to us. We will be delighted to help you out.

About EuroDev

EuroDev was established in 1996 in the Netherlands with a single, defined purpose to help mid-sized North American companies expand their business in Europe. So far, we have partnered up with over 500 companies and helped them define and meet their European business goals. Services provided include Sales Outsourcing, HR Outsourcing, and Digital Marketing. Services provided include Sales Outsourcing, HR Outsourcing, and Digital Marketing.

Disclaimer: While we strive to provide accurate and timely information, please note that HR policies and regulations can change frequently. It is recommended that you seek guidance from our HR consultants to ensure that the data presented here is current and accurate.

Category

Related articles

-

Notice Period and Severance Pay in EU Countries in 2025

8 April 2025While specific rules vary from one country to another, they are typically shaped by national...

Read more -

Unlimited Vacation: Who Offers It and Does It Really Work?

3 April 2025Discover the benefits and challenges of unlimited vacation policies and how companies successfully...

Read more -

Building a Dream Team: Comprehensive Guide |Part II

24 March 2025It requires careful planning, nurturing relationships, and a deep understanding of the elements...

Read more