Switch Contractors to Employees: A Guide for Running an International Business

Since independent contractors are self-employed individuals and therefore liable for their taxes and equipment, many employers think this is the best option for their business. The truth is, contractors can save your company money because you are not responsible for paying their health insurance, vacation time, and other benefits, but the option doesn't come without limitations and risks. If you think that switching your contractors to employees is the way to go, keep reading to learn how to do it.

Why Convert Independent Contractors to Employees

Opposite of what many employers think, contractor agreements come with a great burden of responsibility for the company. The first issue employers see is ending up with penalties if the contractor is misclassified, and that is not the only one. Since contractors are their legal entities, they usually own all or a portion of the work's intellectual property rights. There is also a question of time dedication when you have contractors because they are usually working on multiple projects for various clients at the same time. On the other hand, full-time employees, who can even cost less than contractors in many scenarios, are dedicated to your business only. They are good for maintaining strong company culture and help with retention because most people prefer working under a full-time contract. With many employers struggling to attract and retain talent, having dedicated team members who are helping your business grow is essential for every company.

When to Convert Independent Contractors to Employees?

There are a couple of usual scenarios when businesses decide to convert contractors to employees:

- The contractor is at risk of misclassification

Contractors that are misclassified are a big risk for companies and the least of them being steep fines for failing to pay the appropriate taxes. - Protection of company's intellectual property

As we mentioned earlier, the contractors are entitled to certain rights regarding the work they are providing. It is crucial for every business to protect its delicate intellectual property, and one way to do so is to offer contractors a full-time contract. - The contractor is a strong team member that benefits the business

Once a company finally managed to find a hard-working talent that's the right match for the business, they will want them to work exclusively for them. And the best way to do so is by offering a full-time contract. - The contractor requested it

Sometimes, contractors might request it from employer because the full-time agreement brings many perks for workers, such as minimum wage/hourly wage, paid time off, worker's compensation insurance, health care, unemployment insurance, etc.

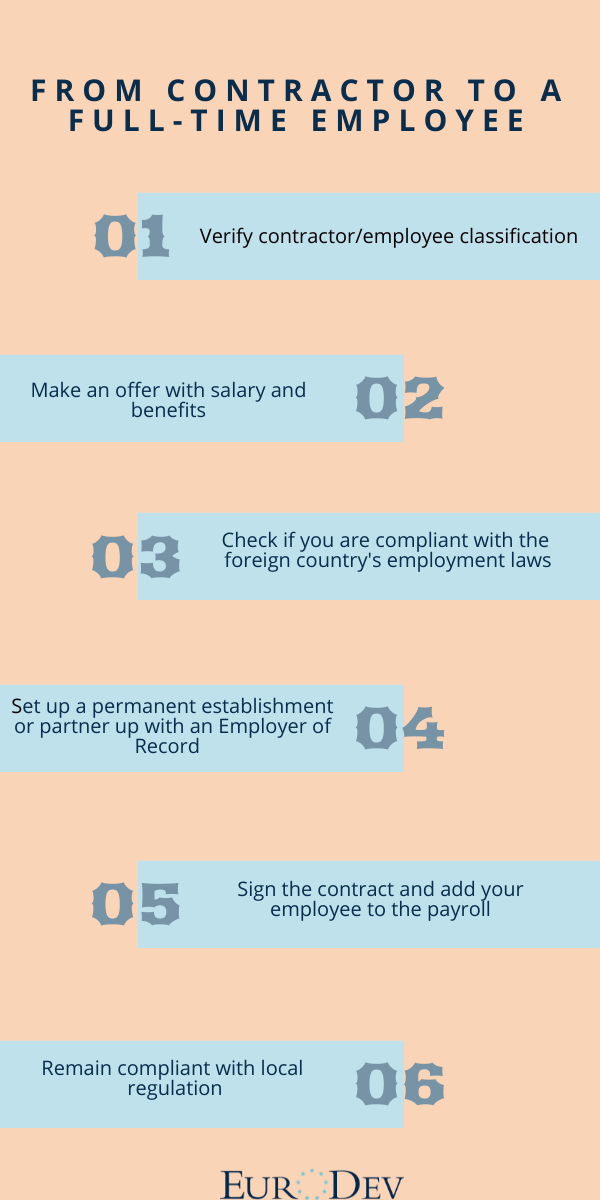

Steps to Convert Contractor to Employee

Verify contractor/employee classification

First, the company has to determine whether or not an international contractor can become a full-time employee based on the nature of their role. In some cases, the tax laws might not allow it.

Make an offer with salary and benefits

Once it is confirmed that the contractor can become an employee, a company has to make an offer that includes salary and benefits. There are legal expectations when it comes to this, but there are also cultural expectations, so make sure you offer competitive salaries and benefits for the country of your employee.

Check if you are compliant with the foreign country's employment laws

This is where things get complicated - a business has to be compliant with the employment law of your employee's country. Since every country in Europe has different employment laws, if a company is hiring more than one employee, this will be challenging. When they get to this stage, businesses often consider hiring an HR Outsourcing partner that will make sure they are compliant.

Bonus read: Europe Labor Laws: Navigating Workforce Regulations

Set up a permanent establishment or partner up with an Employer of Record (EOR) company

In order to hire a foreign employee in their country of residence, a company has to have a permanent establishment. For many companies, setting up an entity is a complex and expensive process, so usually, they partner up with an Employer of record that can convert and manage their overseas employees. This allows companies to hire talent in multiple countries without worrying about whether they are compliant.

Sign the contract and add your employee to the payroll

Once the contract with the full-time employee is signed, a company has to add them to the payroll so they can be paid a full-time salary plus benefits. Without proper documentation and payroll tracking, there's a risk of incorrect payments or misclassification. This is where your EOR (Employer of Record) partner can support you as well. Besides setting up an entity for you, they can also manage payroll for your foreign employees and day-to-day HR tasks.

Remain compliant with local regulation

Labor laws are constantly changing in every country, so once a company has a foreign employer under a full-time contract, it has to make sure you are continuously keeping up with the correct classification of employees, payroll, and local employment laws and taxes.

Conclusion

Converting independent contractors is a big step for any business and when it is done properly, it can bring so many benefits. To make sure your business is compliant, you should consider HR Outsourcing services for your business. Partnering up with a company that's providing Employer of Record services will take care of risks and liabilities that come with employment in a foreign country. You can be sure that employment contracts are in line with local labor laws (in a local language and English) and that your employees are insured correctly. Your HR Outsourcing partner will take over communication with local authorities, take care of payrolling and employer taxes, and also help you determine what type of benefits should you offer based on mandatory and cultural expectations. If you would like to learn more about the benefits that an EOR partner can bring to your business, don't hesitate to reach out!

About EuroDev

EuroDev was established in 1996 in the Netherlands with a single, defined purpose to help mid-sized North American companies expand their business in Europe. So far, we have partnered up with over 500 companies and helped them define and meet their European business goals. Services provided include Sales Outsourcing, HR Outsourcing, and Digital Marketing.

Disclaimer: While we strive to provide accurate and timely information, please note that HR policies and regulations can change frequently. It is recommended that you seek guidance from our HR consultants to ensure that the data presented here is current and accurate.

Category

Related articles

-

Employee Handbook & HR Policies: Germany

29 April 2025While specific rules vary from one country to another, they are typically shaped by national...

Read more -

Notice Period and Severance Pay in EU Countries in 2025

8 April 2025While specific rules vary from one country to another, they are typically shaped by national...

Read more -

Unlimited Vacation: Who Offers It and Does It Really Work?

3 April 2025Discover the benefits and challenges of unlimited vacation policies and how companies successfully...

Read more