Mastering VAT & Tariffs: Avoid Hidden Costs

VAT and tariffs are two words you must know when expanding to Europe. These hidden costs can sneak up on your profits, delay shipments, and turn a simple sale into a logistical headache. Whether you’re exporting to the EU or shipping outside of Europe, understanding how these taxes work is key to keeping your business running smoothly. Let's have a look at the following topics:

VAT Basics in the EU

VAT, or Value Added Tax, is a type of tax applied to almost everything that is bought and sold within the European Union. It is known as a consumption tax because it is paid by the final consumer when they purchase goods or services.

Every country in the EU is required to have a VAT system. There is an EU-wide law that sets basic rules and guidelines for how VAT should work, ensuring that all countries follow some common standards. However, each EU country can still create its own specific VAT rules, such as different VAT rates or special exemptions, as long as they stay within the EU’s basic framework.

The VAT rates also depend on the product or service being sold. The standard rate is usually applied to most goods and services, which can not be less than 15%. But there are also reduced rates for specific items like food or medicine, which can not be less than 5%. The special exemptions will be explained in more detail later.

VAT Charging Process

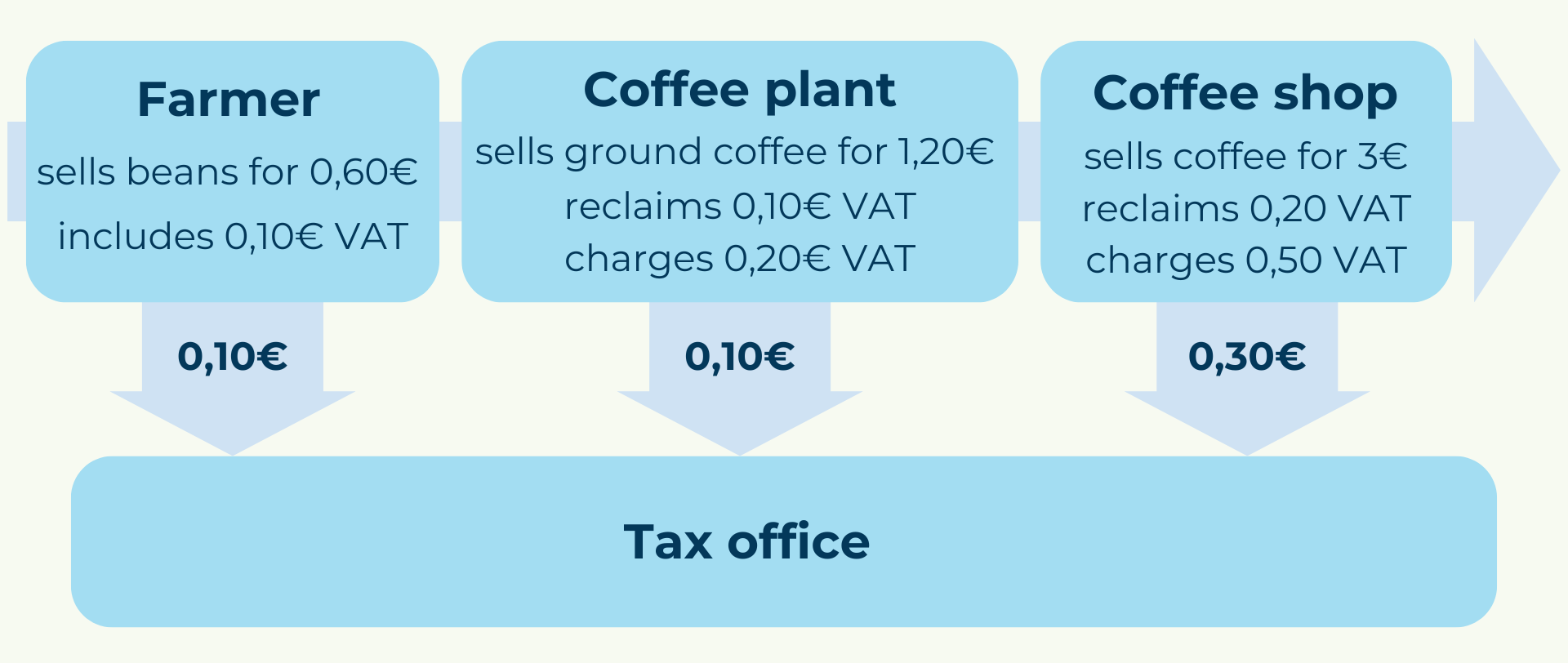

Let’s use a simple example: A restaurant grows, processes, and sells its own coffee for 3 Euros. The customer pays 3 Euros, and this amount already includes VAT (Value Added Tax). In this case, the VAT is 0.5 Euros. This 0.5 Euros is then given to the tax office. It doesn’t matter at what stage the coffee is in the production process—whether it’s being grown, processed, or sold—they must always include VAT in the price. This applies even to the farmer who grows the coffee beans.

VAT Responsibilities

There are different rules when importing goods into Europe, and who pays the tax depends on the terms agreed between the buyer and seller. For example, if the sale is made under Ex-Work (EXW) or Delivered At Place (DAP) conditions, the customer is the one who handles the VAT payments and arrangements. This means that once the goods arrive, it’s the buyer’s responsibility to pay the VAT. However, if the sale is made under Delivered Duty Paid (DDP) conditions, it’s the supplier who has to pay the VAT. The problem with DDP is that the supplier cannot reclaim this VAT later, which means they end up paying extra costs that they can’t get back. This can make the transaction more expensive for the seller.

Common mistakes

When filling out a Commercial Invoice for international shipping, it’s important to provide accurate and clear information to avoid problems at customs. Here are some things to keep in mind:

Don’t just label items as "samples" without further explanation. Customs needs to know the exact type of item. For example, is it a phone, a sweater, or a chair? Each type of item has a different tariff rate. Being specific helps customs determine the correct tariff for the shipment.

In addition, you can only classify actual papers or documents as “documents.” If you’re sending small items, they need to be listed on the Commercial Invoice. Shippers enable you to automatically generate a commercial invoice for parcels, not for documents.

The “Country of Origin” is where the item was originally made, not where it is being shipped from. For example, if a product was manufactured in the USA and then sent from the Netherlands, you must state the USA as the country of origin. This is important because tariffs and duties vary based on where the item was produced.

Items like batteries, flammable substances, or other dangerous goods require special attention, especially for air shipping. Airfreight has strict rules for these items to ensure safety. Always clearly state if your parcel contains such goods and use the appropriate packaging.

Most shipments use the “DAP” (Delivered at Place) terms, meaning the receiver is responsible for paying any VAT, tariffs, or duties upon delivery. Make sure the receiver knows about these extra costs and is willing to accept them, as failing to pay can result in the parcel being held by customs. Being precise and honest on the Commercial Invoice helps avoid delays and unexpected costs at customs, ensuring a smoother shipping process.

Special Exemptions

If you want to repair an item outside of the EU, you can mark this on the Commercial Invoice (CI). This way no tariffs will be raised. Also if an item is only shipped to a country for a short period of time, for example, a tradeshow or demo, it can be marked on the CI to avoid tariffs.

If you are sending an item outside the EU for repair, you can indicate this clearly on the CI by marking it as a “Temporary Export for Repair.” This helps customs understand that the item is not being sold and ensures that no tariffs or duties are applied.

Similarly, if an item is being shipped temporarily—for example, for a tradeshow or demonstration—you can mark it as “Temporary Import” on the CI. In this case, customs will know that the item is not being permanently imported into the country and should not be subject to tariffs.

Category

Related articles

-

What Are the Top European Industrial Tradeshows in 2026-2027?

Last updated: 22 December 2025Discover the top European industrial tradeshows in 2026-2027 if your business is planning business...

Read more -

Why Is 2026 the Best Time for US Companies to Export to Europe?

Last updated: 20 November 2025Discover why 2026 is ideal for U.S. exporters: weak dollar, low rates, and stable EU growth.

Read more -

Robotics to Vision: EuroDev Drives Automation Growth in Europe

Last updated: 22 August 2025Discover key trends and real case studies of North American oil & gas companies innovating and...

Read more